Solve financial services ITOps challenges with AIOps

The financial services industry is experiencing a profound shift. Customers now demand a flawless experience across all touchpoints, including online platforms, mobile devices, ATMs, and physical branches. Any lapse in performance or reliability in these channels can lead to dissatisfaction. Moreover, the competition is intensifying as technology-focused companies, more nimble and innovative than traditional counterparts, are continuously disrupting the market. For financial services IT operations teams, these dynamics intensify the already daunting challenge of ensuring the uninterrupted availability of critical operations across a mix of on-premises technology alongside complex modern systems.

Awareness of several common challenges when handling event management and incident response is important. From there you can outline the crucial requirements you need to prioritize when selecting an AIOps solution.

Financial services ITOps challenges

Our conversations with financial institutions — ranging from regional banks striving to maintain ATM uptime to major institutions processing a vast majority of the world’s capital transactions — have shed light on several vital ITOps challenges.

Digital transformation and legacy system modernization: Navigating the shift to cloud-based technologies such as API integrations, microservices, and containers presents challenges in monitoring your evolving IT landscape. The lack of interoperability between cloud-based technology and legacy on-premises systems significantly slows incident management, complicating the balance between innovation and operational continuity.

Elevated customer expectations and SLA pressure: The imperative to maintain seamless service availability has never been greater. Any disruption in mobile apps, ATM systems, or transaction processing can severely affect customer satisfaction and tarnish brand reputation. In an era where switching banks is easier than ever, it’s a daunting task to meet service-level agreements (SLAs) to keep systems operating smoothly as offerings and technological complexity increase.

Compliance in a regulated environment: Surrounded by rapid technological advancements and fierce competition, ensuring compliance with stringent industry regulations, such as the Digital Operational Resilience Act (DORA) in the European Union, is increasingly complex. The fragmentation between modern and legacy IT and monitoring stacks complicates transparent reporting, making compliance a resource-intensive endeavor for ITOps teams.

Key requirements for financial services ITOps

Teams are looking for new solutions to address these challenges. Their legacy event management tools are not scalable. Manual processes to filter through loads of alert noise are both time-consuming and error-prone. Meanwhile, inconsistencies in monitoring data and the absence of essential context due to siloed tools impede effective incident resolution across observability platforms, resulting in:

- Inefficient investigations

- Unclear prioritization

- Continuous escalation cycles

This is unsustainable. It hinders your ability to quickly resolve outages that keep financial systems running and affects your institution’s future ability to innovate and scale.

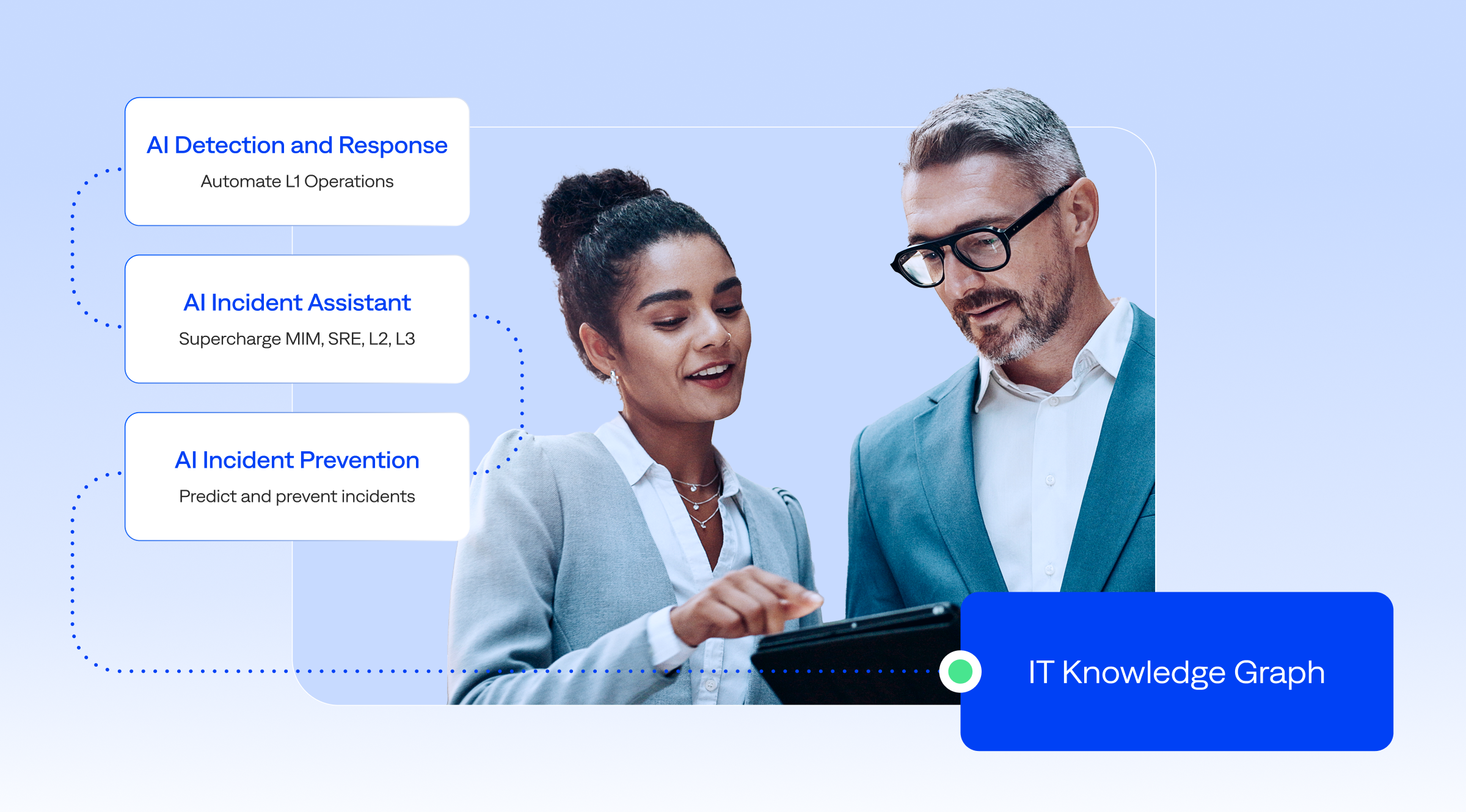

As a result, financial institutions are increasingly turning to AIOps platforms. AIOps revolutionizes IT operations by streamlining siloed workflows, reducing alert noise through advanced correlation, prioritizing critical incidents, maintaining uninterrupted mission-critical system performance, and freeing IT teams to innovate.

Combining industry research and our own conversations with financial institutions, we’ve identified the most common set of needs to consider as you evaluate AIOps solutions:

- Universal integration: Embracing digital transformation and hybrid infrastructures requires a solution capable of seamless integration with both on-premises and cloud-based monitoring sources as well as consolidating siloed data formats — a benefit 91% of ITOps leaders at financial institutions recognize AIOps can deliver to their organization.

- Efficient correlation patterns: With the influx of event data, financial institutions need a robust mechanism to sift through the noise, identify patterns across disparate data, and create a unified view of the IT infrastructure to facilitate efficient incident management.

- Advanced generative AI capabilities: With 82% of financial services IT professionals eager to leverage its advantages, the potential of GenAI to streamline incident resolution processes is increasingly attractive, promising enhanced efficiency and precision.

- Workflow automation: Achieving cost and time efficiencies is paramount. Automation is a critical requirement, allowing you to reduce manual interventions and enable ITOps teams to focus on innovation.

- Comprehensive reporting: Given the regulatory scrutiny in the financial sector, it’s wise to prioritize solutions that provide straightforward reporting and dashboard capabilities to ensure compliance and easily facilitate audits.

Real-world stories of improved service reliability

Financial services organizations have realized key advantages from collaborating with BigPanda. In particular, they’ve improved the dependability of essential operations that support services like payments, loans, and other transactions. Integrating BigPanda AIOps technology has proven transformative, enabling institutions to cut through alert noise and enhance the resilience of mission-critical operations.

Take, for example, a multinational financial institution that manages and advises on a diverse asset portfolio. Hampered by a legacy system and lack of context-rich alerts, its incident response process was sluggish. Each time an outage occurred, the ITOps teams had to sift through tools constantly to find the correct information and identify appropriate stakeholders across siloed tools.

Leveraging out-of-the-box correlation patterns, BigPanda streamlined the organization’s siloed, hybrid infrastructure by processing, normalizing, filtering, centralizing, and enriching event data. This transformation yielded high-quality, context-rich alerts, making them actionable and significantly reducing the team’s MTTR by enabling faster root cause identification.

“BigPanda has been a highly responsive platform for our distributed service centers,” explained the product owner. “Our MTTR reduction is predominantly due to BigPanda’s out-of-the-box correlation, which has enabled the majority of our events to be automatically resolved without manual intervention.”

Further enhancing operational finesse, the institution leveraged Automated Incident Analysis. This feature, powered by historical data, automates the generation of succinct, actionable summaries to delineate a clear resolution path.

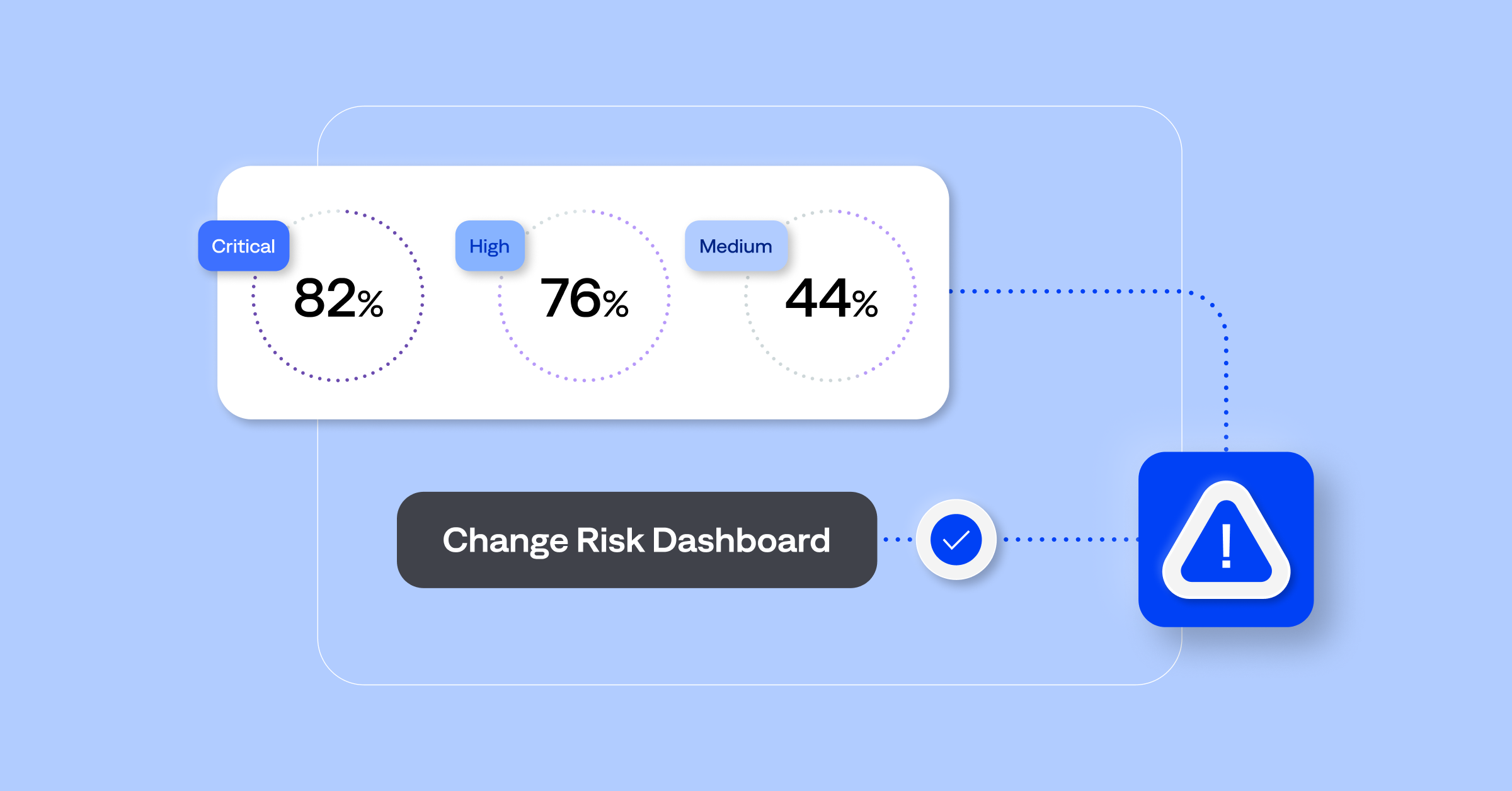

Similarly, a leading U.S. bank tapped into BigPanda Unified Analytics to gain a panoramic view of its IT landscape. Utilizing out-of-the-box dashboards, the ITOps teams can now easily identify low-quality alert sources, evaluate team responsiveness to incidents, and assess the impact of system changes, thereby simplifying compliance reporting access.

Take the next steps

BigPanda equips financial services ITOps teams with the tools needed to maintain the uninterrupted operation of mission-critical services vital to customer satisfaction and regulatory compliance. By utilizing BigPanda enrichment, correlation, and GenAI capabilities, these teams can enhance operational efficiency through automation, eliminating manual tasks. And with streamlined operations, ITOps teams gain time to focus on innovative projects to fuel growth and broaden the customer base, thereby surpassing today’s banking customer expectations and securing their loyalty and trust.

Visit the Incident Response for Financial Services page to discover more about BigPanda’s AIOps capabilities.