Benefits

- Improve customer loyalty: AI-powered analysis safeguards core services and ensures seamless user experiences.

- Modernize legacy systems: Unify on-premise and cloud monitoring to advance digital transformation..

- Reduce regulatory penalties: Dashboards and audit logs demonstrate compliance and mitigate regulatory risks.

- Accelerate incident resolution: AI-powered insights provide real-time troubleshooting and remediation.

Financial institutions operate in a competitive and heavily regulated environment, with high customer expectations. These pressures create substantial IT challenges as organizations strive to scale and maintain a competitive advantage.

Financial institutions face numerous challenges while trying to scale their organizations and achieve a competitive advantage over their counterparts, including:

- High customer expectations Financial institutions manage critical assets, and any service disruption can severely damage brand reputation, lead to customer churn, and negatively impact profitability. Customers expect constant and reliable access to their funds.

- Stringent regulatory compliance Governments worldwide impose strict regulations on incident management, requiring financial institutions to adhere to complex frameworks. The complexity of modern IT infrastructures and siloed data makes maintaining compliance difficult.

- Digital transformation Many established financial institutions rely on outdated legacy systems that support essential services. These systems, often lacking current documentation or expert knowledge, complicate troubleshooting and incident resolution. With the influx of alert noise from legacy and new digital infrastructure, IT teams face overwhelming alert volumes that demand manual investigation and slow incident response times.

Fortifying financial IT with agentic ITOps from BigPanda

BigPanda helps institutions secure critical financial infrastructure by using agentic AI to quickly detect, investigate, respond to, and prevent outages across hybrid IT environments.

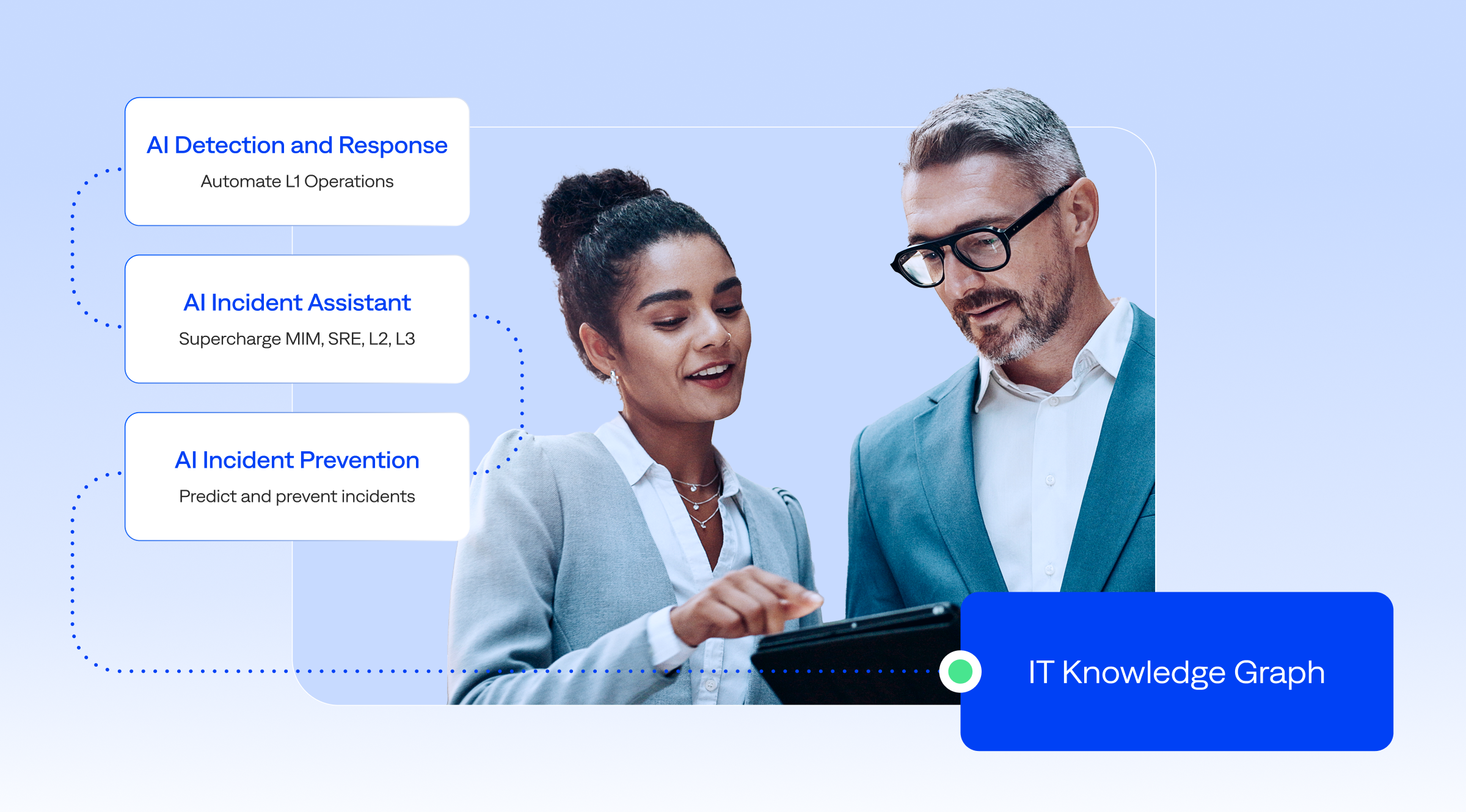

Agentic ITOps from BigPanda optimizes operational resilience with AI Detection and Response. Leveraging the IT Knowledge Graph, BigPanda correlates signals from numerous sources to identify early indicators of incidents and anomalies. L1 teams receive real-time, contextual insights for confident first-contact response, drastically reducing expensive escalations.

BigPanda also safeguards brand reputation and ensures regulatory compliance during major incidents. The BigPanda AI Incident Assistant agentically gathers context for incident response teams to rapidly identify probable root cause, reducing the duration and cost of bridge calls. BigPanda streamlines collaboration across siloed teams and automates audit-ready postmortems, accelerating investigation and resolution while satisfying strict compliance requirements.

To ensure end-to-end stability, AI Incident Prevention detects and assesses high-risk changes and recurring incidents using AI-powered change risk intelligence to prevent change-related incidents from impacting core financial applications and services. Automated change analysis enables proactive and scalable change governance, improving service reliability and facilitating digital innovation.

“AIOps saves us time, letting us focus on resolving problems instead of combing through thousands of alerts to find the problem. It’s transformational and game‑changing.”

Chuck Adkins

Chief Information Officer

AI Detection and Response

AI Incident Assistant

AI Incident Prevention

Challenge

Business value

AI Detection and Response

Challenge

Business value

AI Incident Assistant

Challenge

Business value

AI Incident Prevention

Challenge

Business value

“For financial services organizations, ensuring the performance and availability of critical business services is paramount. AIOps provides information and context to help IT operations and Incident Management teams improve their response to and even prevent potential problems for those critical services.”

Paul Bevan

Research Director, IT Infrastructure

Bloor Research