Safeguard critical insurance services with agentic IT operations

Ensure policy, claims, and customer systems run reliably to reduce risk, protect revenue, and meet regulatory requirements.

Ensure reliable insurance operations at scale

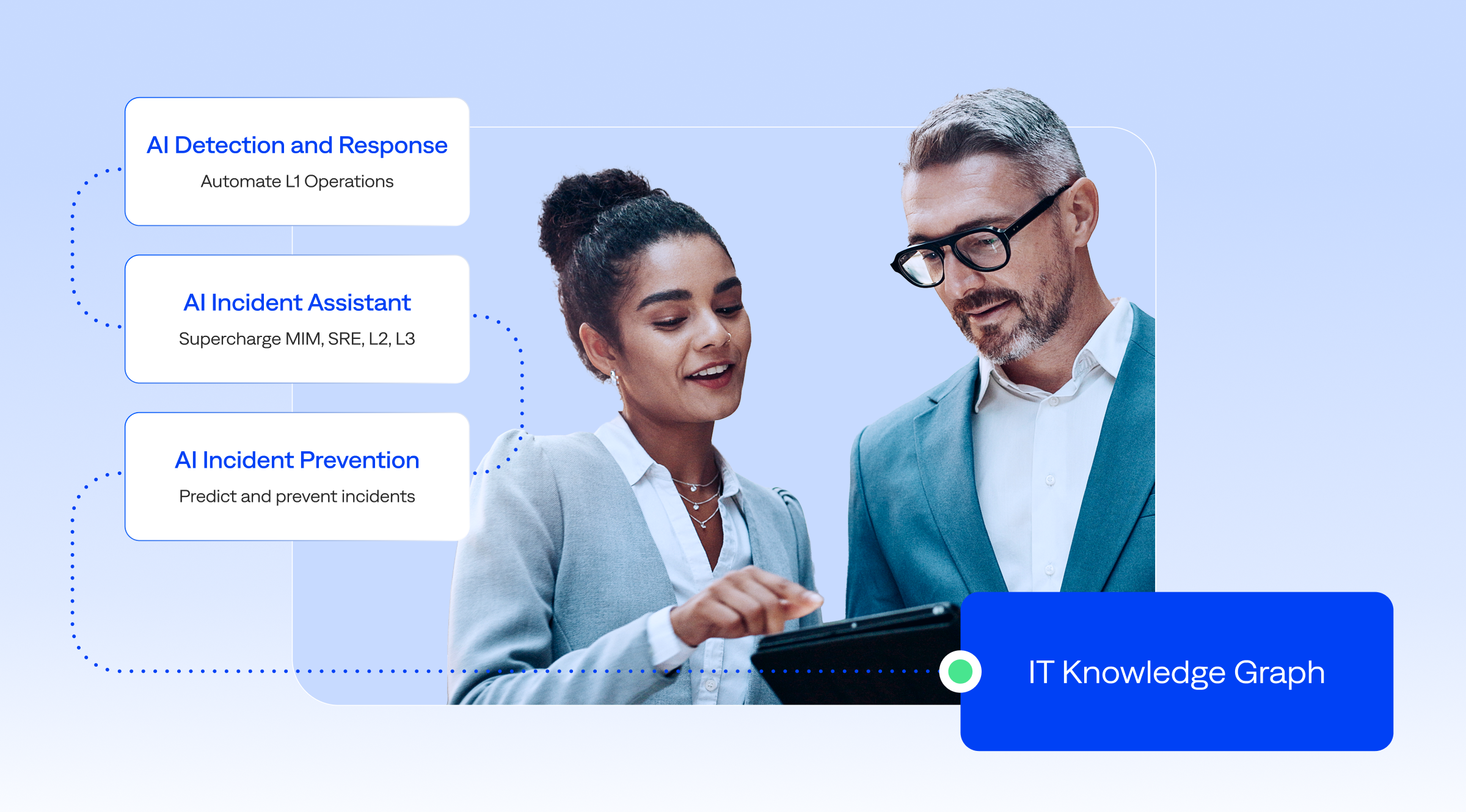

Insurance organizations rely on complex systems for policy administration, claims processing, and customer service. BigPanda AIOps detects issues early, resolves incidents faster, and prevents disruptions

Deliver reliable insurance services

Insurance platforms generate a large volume of operational signals. BigPanda AI Detection and Response helps teams detect issues earlier and maintain reliable availability across policy, billing, and payment systems.

Nurture lasting customer loyalty

When customers need critical support, fast resolution is critical. The BigPanda AI Incident Assistant streamlines investigation and coordination across teams, reducing incident duration and protecting policyholder trust.

Achieve scalable incident management

As insurance environments become increasingly complex, teams require a shared understanding of context. The BigPanda IT Knowledge Graph unifies operational data across monitoring, ITSM, and collaboration tools to support consistent, scalable incident management.

Prevent regulatory penalties and fees

Insurance IT teams must minimize risk while maintaining compliance. BigPanda AI Incident Prevention identifies risky changes and recurring patterns early, helping prevent outages, reduce audit exposure, and protect regulatory compliance.

E-BOOK

From reactive chaos to automated control: Transform ITSM with an agentic AI-powered incident assistant

Learn how your enterprise can save up to 30 minutes per incident in manual work.

Deliver resilient insurance operations

“We’ve automated an average of 83% of alerts that come into BigPanda. Meaning the bulk of our alerts now get resolved automatically or receive a ticket without our team having to manually investigate it from beginning to end.”

FAQ

How does BigPanda AIOps help insurance providers prevent outages?

BigPanda analyzes operational signals, change activity, and historical patterns across insurance systems to identify risk early. This allows teams to take preventive action before issues disrupt claims processing, policy management, or customer portals.

How does BigPanda support regulatory compliance?

By reducing outages and providing consistent operational insight, AIOps from BigPanda helps insurance organizations minimize regulatory risk. Unified analytics and incident context support audit readiness and reliable service delivery across regulated environments.

Does BigPanda work across hybrid systems?

Yes. BigPanda integrates with cloud, on-premises, and hybrid systems commonly used by insurers. This creates a unified operational view across legacy platforms, modern applications, and third-party services.

What makes BigPanda different from traditional AIOps tools?

BigPanda delivers a full agentic IT operations platform that combines detection, response, and prevention. Powered by the IT Knowledge Graph, it helps insurers reduce cost, risk, and operational effort at scale.

Check out more related content

Webinar

Unleashing Agentic IT Operations

Explore the vision behind our agentic IT operations platform—built to help enterprises automate ITOps and incident management.