Benefits

- Protect customer trust and retention: Reduce service disruptions that impact claims, billing, and portals. Earlier detection, faster resolution, and proactive prevention help maintain reliable experiences and strengthen long-term policyholder loyalty.

- Ensure availability of critical services: Maintain consistent access to claims, policy, and customer systems by detecting issues early, coordinating response efficiently, and preventing outages that disrupt core insurance operations.

- Reduce regulatory and operational risks: Gain clearer visibility into incidents, changes, and risk patterns. Improved context and auditability help minimize compliance exposure and support faster, more confident regulatory reporting.

- Modernize without increasing instability: Support ongoing platform and application modernization while reducing change-related incidents. Proactive risk identification enables insurers to innovate confidently without compromising service reliability or security.

Insurance organizations operate in a high-stakes environment where service reliability, customer trust, and regulatory compliance directly impact revenue and brand reputation. Core systems that support claims processing, policy administration, billing, and agent interactions must perform flawlessly at all times. Even brief disruptions can delay claims, frustrate policyholders, and create downstream financial and regulatory risk.

As insurers grow through mergers, acquisitions, and digital expansion, their IT environments become increasingly complex. Data is spread across legacy platforms, cloud services, and third-party systems, limiting visibility and slowing response times during incidents. Manual, reactive incident management extends downtime, increases operational costs, and pulls skilled teams away from strategic initiatives.

Over time, this reactive model constrains innovation and makes it challenging for insurers to meet the expectations of their customers. To remain competitive, insurance leaders must reduce operational risks and costs while enabling continuous modernization. This requires a more intelligent approach to IT operations that goes beyond reacting to incidents and instead focuses on prevention, efficiency, and resilience across the entire enterprise.

- High customer expectations and service continuity Policyholders, agents, and partners expect uninterrupted access to insurance services across digital and self-service channels. Incidents that impact underwriting, claims, billing, or portals quickly erode trust, increase call volumes, and drive customer churn. Ensuring consistent availability is essential to retain customers and protect revenue.

- Regulatory compliance and operational risk Insurance organizations operate under strict regulatory and security requirements. Outages, data exposure, or delayed incident response can result in audits, penalties, and SLA breaches. Leaders need early visibility into risk and fast resolution to maintain compliance and reduce financial exposure.

- Modernization without instability The ongoing modernization of policy and claims platforms introduces new dependencies and risks. Without unified visibility and automation, change-related incidents become more frequent. Insurers must modernize confidently while maintaining stability, security, and performance across evolving environments.

How agentic ITOps from BigPanda can help

The BigPanda Agentic IT Operations Platform helps insurance organizations reduce outages, lower operational risk, and protect customer trust by unifying incident detection, response, and prevention across their entire IT infrastructure. By connecting data from monitoring, ITSM, change, and collaboration systems, BigPanda provides a unified operational foundation that enables faster decision-making and improved business outcomes.

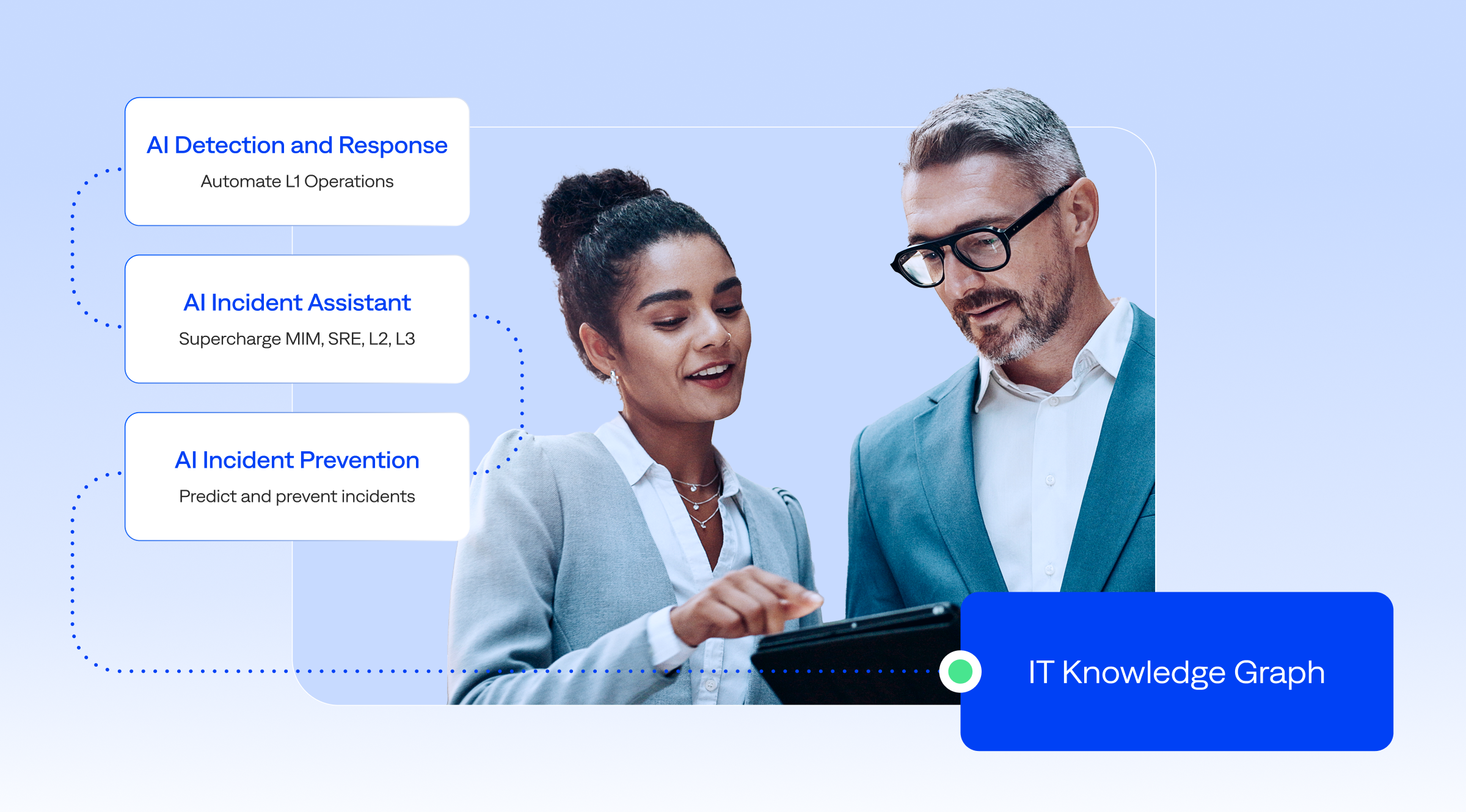

When issues arise across hybrid insurance environments, noise and limited context slow response. BigPanda correlates signals across monitoring, ITSM, and change management systems to quickly surface meaningful incidents and provide actionable context. This approach, enabled through AI Detection and Response, helps teams identify problems earlier and reduce the customer and revenue impact of outages.

Once an incident is underway, insurance teams must rapidly coordinate across infrastructure, application, and service owners. BigPanda automates investigation, communication, and coordination to reduce manual effort and accelerate resolution. The BigPanda AI Incident Assistant enables teams to operate more efficiently, resolve incidents faster, and minimize disruptions to policyholders and agents.

Modernization and frequent system changes introduce risks that traditional tools struggle to manage. AI Incident Prevention analyzes change activity, dependencies, and historical outcomes to identify risk before deployments cause failures. Insurers can confidently modernize claims and policy platforms while reducing recurring incidents and operational exposure.

These capabilities are all powered by the IT Knowledge Graph, which continuously learns how insurance systems behave in real-world conditions. By reasoning over dynamic operational context, BigPanda enables coordinated action across detection, response, and prevention, helping insurers reduce costs, lower risks, and deliver reliable services without compromising compliance or innovation.

“We’ve automated an average of 83% of alerts that come into BigPanda. Meaning the bulk of our alerts now get resolved automatically or receive a ticket without our team having to manually investigate it from beginning to end.”

Mark Peterson

IT Operations Supervisor,

AI Detection and Response

AI Incident Assistant

AI Incident Prevention

Challenge

Business value

AI Detection and Response

Challenge

Business value

AI Incident Assistant

Challenge

Business value

AI Incident Prevention

Challenge

Business value

“BigPanda AIOps unifies operations and observability teams, their tools, data, and their processes so operators can understand, prioritize, and investigate every incident immediately.”

Jon Brown

Senior Analyst,

Enterprise Strategy Group